Here is some quick analysis on why Brazin is a good company to purchase at its current price.

Overview

Brazin is a diversified retailer selling recorded music, DVDs, womens lingerie, cheap jewellery, sleep wear, swim wear and home wares. It operates some 700 retail stores Australia wide. Its brands include Sanity Entertainment, Virgin entertainment, BNT (Formally Bras n Things), Aztec Rose, Dusk, Diva, HMV and Ezydvd.

Company Strategy

A change in management has shifted the strategy to rebuilding core brands and exiting loss making businesses. Brazin excited the loss making operations of Ghetto and Insane in 2005.

Growth will be driven from store rollout of established chains and development of Dusk and Diva chains and consolidation of recent acquisitions. BNT should be driven by successful marketing of the Short Stories and Hanky Panky lines. BRZ is targeting 15 new stores by June FY06. Organic growth should benefit from new products in the Hanky Panky and the Truly Me lines. Insatiable demand for value fashion accessories should see Diva continue to deliver strong growth. We expect store expansion and marketing initiatives to drive organic growth. BRZ had 101 stores by February 2006. Stores are usually profitable in a short time. BRZ acquired 32 HMV stores for $4m. Store numbers are likely to be reduced to 25 and rebranded to Sanity or Virgin once leases expire. BRZ plans to install MP3 download kiosks, to offset the pressure from iPod sales and declining price points in CDs and DVDs. These kiosks were launched in February 2006. BRZ 50% acquisition of EzyDVD Pty Ltd is part of its strategy to gain exposure to a growing sector of the entertainment business. Continued roll out of stores will grow top line sales. EzyDVD is expected to have 80 stores by June 2006.

Brazin reported NPAT up 29.6% to $19.3m for the half-year ended 31 December 2005. Revenues from ordinary activities were $300.9m, up 21.4% from the same period last year. Diluted EPS was 16.2 cents compared to 12.6 cents last year. Net operating cash flow was $55.8 compared to $50.8 last year. The interim dividend declared was 8.5 cents compared with 8.0 cents last year. The halfs results were driven by strong sales by the group, including the newly acquired HMV business. The Diva chain also made a solid $7.4m contribution to the group profit.

All brands reported improved stock turn rates and inventory productivity during the half. Ghetto and Insane are in the final stages of closure. The cumulative FY06 costs of discontinuing these operations are estimated to be $2.4m after tax, slightly higher than the previous estimate of $2.0m after tax.

Institutional Ownership

A stock requires institutional ownership if it is to grow. This is because it is mainly the institutions that push the price of stocks higher with their ever increasing inflow of money (from superannuation). If a stock has too much institutional ownership it makes the stock stagnant and/or a favourite for speculators. This is taken from the 2005 annual report and maybe slightly out of date. The top shareholders are below:

| Shareholder | Percentage of Company |

| Yoda Holdings | 58.9% |

| National Nominees | 5.9% |

| J P Morgan Nominees Australia | 4.5% |

| RBC Global Services Australia | 3.8% |

| Coloskye Pty Ltd | 2.7% |

| Westpac Custodian Nominees | 2.2% |

| Citigroup Nominees | 1.4% |

| Cogent Nominees | 1.1% |

Looking at this there is only one major holding which virtually controls the company. This is I believe the former owners of the company before listing.

This gives ample room for institutional investors to move in and acquire major positions in the company. It should eb noted that some institutions have already taken notice those being Westpac, Citigroup, JP Morgan and National.

Share ownership is also available as a breakdown of the number of shares owned. This is available below:

| Number of shares | Shareholders |

1-1,000 | 970 |

1,001 – 5,000 | 1,779 |

5,001 – 10,000 | 496 |

10,001 – 100,000 | 294 |

100,001 + | 34 |

TOTAL | 3573 |

This shows the majority of investors are small investors with up to 15K. It also shows that there are more than 30 which have a large stake ($150K+) invested into the stock. This breakdown shows that this stock appears to be a favourite of small investors.

Facts to consider:

- The top shareholder has more than 50% of the company

- The top ten shareholders own 82.1% of the company.

- The top twenty shareholders own 85.2% of the company

What this is telling us is that only 41% of the company is there to be traded which means it may have higher volatility due to the decreased number of shares available for tradeing. Only 15% of the company is available to those not in the top 20 shareholders. This is an interesting statistic as if one of the institutional investors decides to sell their holding it could dramtically push down the price. On the other hand if a instutional investor wishes to purcahse the stock it could dramatically increase. This presents us with lots of opportunities to find value in the stock.

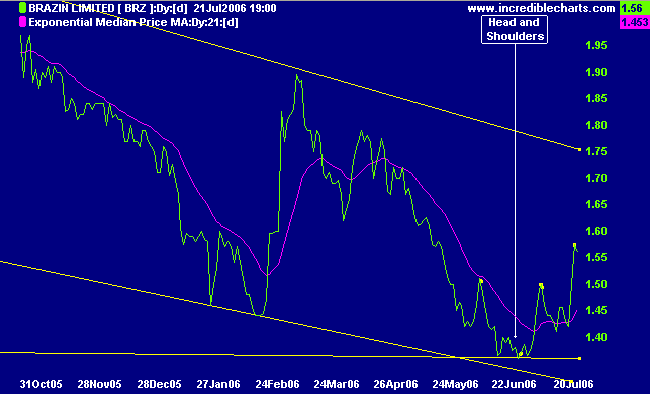

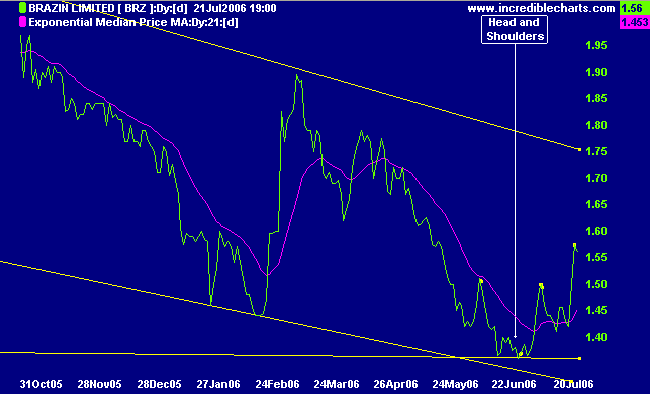

Charting the stockLooking at the chart we can see the stock is up during the last three years but it has been steadily declining for the last year at least. It has found some support around 1.35 where it has rebounded. The overall trend for this stock is not good but short term we should see a rebound to the upper trend line which will be around $1.70.

Below you can see it has formed a head and shoulders pattern and this is one indication that the stock may be finishing its downtrend.

Growth The latest half year earnings show growth in the following areas:

- Sales growth of 21.4%

- EBITAD growth of 31%

- EBIT growth of 27%

- Profit before Tax growth of 11.4%

- Profit after Tax growth of 26.8%

- Store Growth of 6.1%

- EPS up 28%

The first thing to look at is where did this growth come from. This is explainable by delving a bit deeper into the numbers :

- These results were over a 27 week period as opposed to 26 weeks

- These results had an extra "Christmas trading week" this year and could have increased sales

- Purchase of Diva contributing to these results for first time

- HMV was acquired in October 2005 and may have had some impact.

- Effective cost management is quoted which means cost cutting measures were used.

- Removeal of loss making business and focus on core business has helped.

Future growth is likely to come from :

- Good numbers from the core brands which are profitable.

- Vertical integration is being explored to increase margins.

- Enhanced tradig terms due to market share dominance in entertainment industry

- Further cost cutting measures

- The final removal of loss making brands from the business

- Consolidation of recent purchase of HMV

- Innovative product decisions ( Music Kiosk is a good idea and should generate solid profit)

Profitability

Profitability looks at the area on how much money (profit) is the company generating relative to the money which is invested into it. This is a key area as we need to invest in companies that make money and produce a return for their shareholders.

The first figure is Return on Assets. To determine ROA we do the following: Net Profit Margin / ( Sales / Assets ) = 3.1 / (502/ 251) = 1.55. Sales / Assets is the Asset Turnover.

The ROA tells us how efficient the company is turning the assets it has into money. This shows us that the company generates sales at 55%. This is explained as follows. Each Asset generates about 2 times (501 / 251) its values in sales. Therefore we divide the Profit by the Asset turnover and we get the return on the assets which works out to be about 55%. This is not a bad figure for this type of business.

Return on Equity is an industry standard to determine how well a company is performing and how well it is in creating wealth for its shareholders. The ROE for BRZ has been outstanding. The past 8 years has shown ROE figures of 20% or higher . This shows the company is doing a good job of managing their capital.

There are 3 ways a company can boost its ROE figures and this needs to be investigated before the figures can be regarded as authenticate returns. The ways a company can boost their ROE figures are net margins, asset turnover and financial leverage.

Net margins for BRZ are ok, and while it has a fair bit of debt shown by debt to equity ratio of 89/96 or 92% I think the companies management are on the correct path and should slowly reduce the debt over the next few years. To see whether the debt has helped the shareholders gain money can be seen by the ROE being higher than the ROC which is is in this case ( 20.8% for ROE vs 11% for ROC).

Free Cash Flow is another measure which can give some indications into how a business is prospering. Free Cash flow is very important as this is the excess money generated by the business which is available for shareholders ( or available for the company to reinvest and expand the business ). My preference is usually for the company to give dividends as I can probably better invest the money elsewhere. Looking at the financial report shows that BRZ likes to have high Payout Ratios (81%) and provides adequate dividends at 7.5%.

Free Cashflow is determined by taking the cashflow and removing the capital expenditure.

2005 Free Cash Flow = Cashflow – Capex = 7.6 – 18.7 = -11.1.

This shows that there may be issues with the company. Looking back a few years shows that this is an anomoly and is due to them purchasing a stake in Diva and Dusk. If we look back at the previous years we see a consistent value of around 20-25 million. Deteriming if this is enough free cashflow can be tricky as a guide we should aim for 5% of the sales revenue. Free Cashflow as per Revenue = 20 / 502 = 3.9% which is slightly below our target of 5%.

Overall while this is lower than our 5% I can see it growing in the future due to the direction management is taking with its brands and costs. I expect this figure to rise slightly as they remove unprofitable businesses.

Overall the company is profitable and managements direction to sell off any unprofitable businesses can only help the overall profitability.

Financial Health

Financial health looks at the current snapshot of the company and how well a foundation it has created itself. A company needs a strong financial health to ensure it does not run into extra costs and other financial burdens which could arise in the future.

The first figure to examine is the debt to equity. In this case it is 92%. This is a bit high due to recent purchases but I believe the purchase was a good acquisition and should enhance the profitability of the company.

The second figure is times interest earned which is how many times the company could pay the interest on its debt. The figure for the company is 7 which is a good figure considering the ASX average is 5 and the sector average is 6. This means they make enough money to cover their interest payments by 7 times.

The current ratio is how quickly a company could sell off assets to pay off debt. A general rule is 1.5 and BRZ currently has a current ratio of 1.37. This is ok but 1.5 is the benchmark. The quick ratio is very similar to above except it is a bit more meaningful as it removes inventories which may be sold at a price lower than they are worth. A ratio above 1.0 is a good figure and BRZ is showing 0.21. This adds a bit of risk to the company. It means without invetories the company does not have much in the way of collateral for debt payments. This company is inventory intensive and thus a lower figure can be expected.

A last test is to ensure the company has more Assets than it does liabilities. In this case BRZ has 328 million in total assets and 231 in total liabilities. This means if something drastic happened all debts could be paid and 97 million is available for shareholders.

Risks

There are numerous risks to this company including :

- They sell luxury items which will not sell well in a recession. Interest rate increases and rising Petrol costs could hurt the business.

- Ongoing price deflation on DVD'swill hurt their entertainment businesses

- They are a seasonal stock and make most of their money in December and January.

- They are competing agaisnt fierce compeititon and brand recognition is important. Losing brand recoginition could severaly hurt the company.

- They have a large debt to equity ratio which they will need to reduce quickly in case of interest rate rises.

Management

Management is one of the most important aspects to look at when deciding whether or not to buy a company. it is management that makes all of the important decisions which could make or break the investment.

Firstly the renumeration policy should be checked. While I think all directors are overpaid, it is worthiwhile checking they are not excessively overpaid. The total cost of all directors is 2 million. This is a substatial increase on the year before which was 1.4 Million. The renumeration is broken into 3 parts, fixed salary, performance incentives and long term incentives. This at least puts some of the 2 million at risk and gives management a carrot to aim for. Overall 2 million is a bit excessive considering the Net profit was only 10 million. This is 20% of the overall profit. It should be under 10% of net profit.

Managements direction for the future needs to be looked at to ensure they are not boosting numbers now which will ultimately decrease profits in the future. Looking at BRZ they have focused on reducing costs which is a good thing. They are also selling off unprofitable businesses. This is also a good idea. I also like their direction of expanding the company by buying stakes in Diva and Dusk.

Overall I like the direction management is taking the company. They seem to be open about issues within the company and the direction they intend to take. They are coming up with new innovative solutions ( Music Kiosk) and are improving efficiency in existing operations ( BNT ).

Target Price and Sell Targets

The target buy and sell points will be different depending on different peoples analysis of the company. I do not subscribe to the Discounted value system and instead prefer some easier figures to tell me whether or not the company is at a good value.

Firstly I like a high dividend. Usually I would aim for 5% fully franked but there are always exceptions to the rule. In this case the dividend yeild is closer to 7% fully franked. I like a higher dividend to provide some buffer against a falling price. Based on the 5% rule I would stake a rough estimate of approx $2.30 ( 11.5c / 5%).

Secondly I like to see a PE ratio which is not too high. This differs between sectors. BRZ is at 7.8 while the market sits at 15.72 and 13.60. This shows that BRZ has a very low PE ratio compared to the average. I like PE ratios which are low as they provide a quick indication that the company is earning good money relative to their value. Something to be careful of though is that there might be a low PE because the price has dorpped based on thoughts that the future earnings might be smaller. Looking at BRZ shows estimates are for an increase in EPS from 20 to 25. If the estimates are correct assuming the PE ratio remains steady we should see BRZ move from the current price to $1.95. If we assume earnings are going to reamin steady and BRZ comes back to the sector average we should see it rise to $2.70 .

Technically I can see the share moving back to resistance around 1.70. It would need to break this level before it could start a nice uptrend.

Based on the price estimates of $2.30, $1.95 and $2.70 We would look for a buffer where we see value. Due to some of the comments above about managementsx high renumeration and a few of the risks we need to take a larger buffer. usually a 20% buffer is a good start but in this case a 30% buffer may be more reliable due to the slightly higher risks.

Using a 30% buffer puts the buy for each of the estimates at around $1.61, $1.36 and $1.89. This is a broad range of estimates on the value of the company. I like to take a figure somewhere between the lower two values and this would indicate a value somewhere around $1.40-$1.50.

Sell targets would be analaysed as the share releases new reports but initially we should stick to our lower estimated value of $1.95. At this price the share would be fully valued and any gain from there would be minimal. At that stage we should look for other shares unless this share is showing reasons for its solid performance.

Overall

I would declare this share as a medium risk investment with a possible Buy price of $1.40 to $1.50. Aim for taking profits around $1.95 which is a 30% profit.

Disclaimer : Please remember these are not share reccomedations for you as I have no idea what type of investor you are or what your financial position is. This is my analysis of the company and what prices I feel I would or am buying. I currently own BRZ and bought it at $1.40 a few days ago.